The Stochastics, or Stochastic Oscillator as it is more officially known, was first established in the 1950s by George C. Lane and is suggested for inclusion in any forex directory of essential technical indicators. Furthermore, any technical analysis method that contains indicators and is given by an online forex broker will include a Stochastics calculation.

Lane created the Stochastics indicator to aid financial market traders in identifying severe market situations that could lead to counter-trend corrections. The Stochastics Oscillator is typically adjusted to a range of 0 to 100, with indicator values below 20 indicating oversold markets and values above 80 indicating overbought markets.

Situations when the market frequently closes around the high value of the Stochastics range tend to signal the presence of purchasing pressure and hence a net accumulation of the asset from a qualitative standpoint. Alternatively, if a series of market closures occur at the low value of the Stochastic Oscillator indicator, this indicates that selling pressure is present and that the asset is being distributed net.

The Stochastics Oscillator Calculation

The Stochastic Oscillator is a graphic representation of how the market’s most recent close compares to the market’s high-low range over a set of time periods. As a result, it aids traders in determining how extreme current price movement is in comparison to how it has moved at their currency brokers in the recent past.

The Full, Fast, and Slow Stochastics Oscillators are the three types of Stochastics that are typically available. The percent K line, which pertains to the market’s close compared to the high-low range recorded over a given number of periods, is present in each of these indicators, as is the percent D signal line, which is a moving average of the percent K line.

The computation of the Full Stochastics frequently necessitates the use of three crucial numerical parameters. They are the percent K line and percent D moving average time periods, as well as a slowing parameter. The typical default values for these parameters are 5, 3, and 3, therefore Stoch would be a shorthand for this indication with those settings (5,3,3).

Traders can also commonly define the type of moving average to use when calculating the percent D line, as well as the price range to compare to the current close. The high/low price range and a simple moving average are the standard default choices for these.

Sample Chart of the Stochastics Oscillator

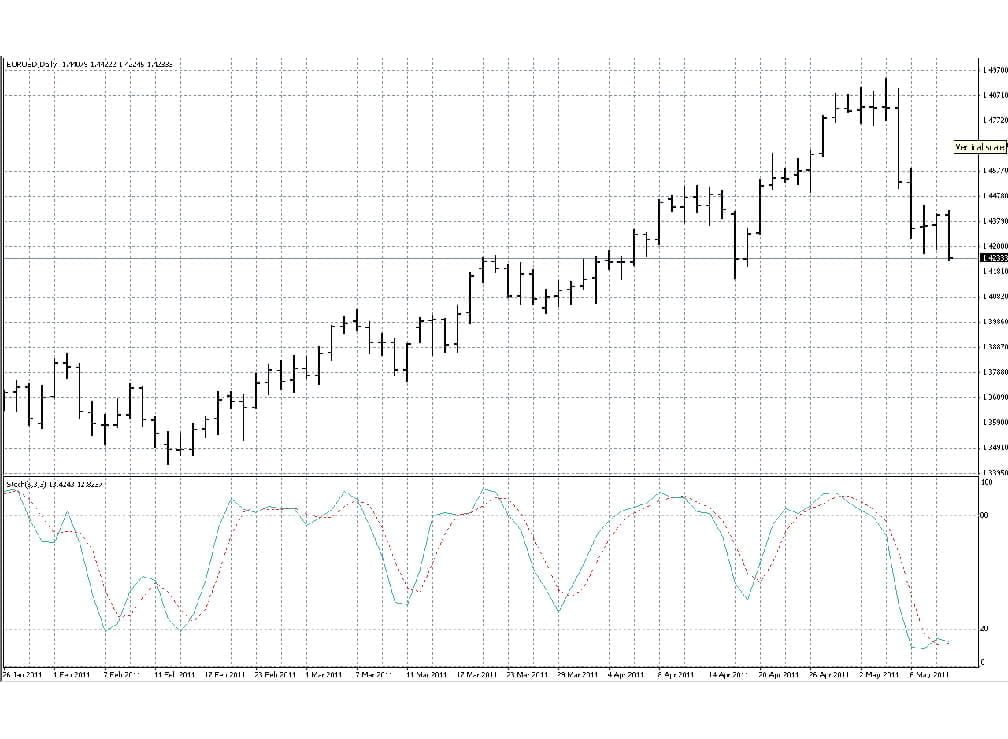

The graph above shows an actual daily bar chart for the EURUSD currency pair with the two lines of the Full Stochastics Oscillator or Stoch(5,3,3) plotted in the indicator box in pale blue and red beneath the price movement and on the same time scale as the price action. It was created using the popular and rather complex MetaTrader4 forex trading platform, which is used by a number of online forex brokers.

The dotted lines in the Stoch(5,3,3) indicator box at 80 and 20 respectively illustrate the borders of overbought and oversold regions for the Stochastics indicator, which is normalized and can range from 0 to 100.

When this chart was obtained using a demo online trading account, the Stoch(5,3,3) indicator had a current value of 13.4243 for the solid blue line and 12.8237 for the dotted red line, and it had recently generated a buy signal due to a crossover of the lines seen in oversold zone.

Applications of the Stochastics Indicator

The Stochastic Oscillator can be used in a variety of ways by current technical analysts in their forex market analysis. Many foreign exchange brokers’ websites feature the popular indicator, which is frequently highlighted in technical forex evaluations.

When the percent K and percent D lines crossed in oversold or overbought zone, Lane offered the Stochastics indicator as a trading signal system that would identify counter trend transactions. Furthermore, the Stochastics indicator’s value can be used in conjunction with other technical indicators to identify when a market is overbought (Stochastics>80) or oversold (Stochastics20) and thus ready for a countertrend correction.

This Stochastics feature can assist trend traders in closing out their trend following positions in their online trading account. Swing traders also utilize the Stochastics to trade with a trend and then against it during correction times through their currency brokers, and the Stochastics may predict when a correction is likely to occur.

Traders on the lookout for market corrections could search for extreme Stochastics readings, such as over 80 for overbought markets and under 20 for oversold markets. They might also look for the traditional percent k/ percent D crossover signal in severe territory on the Stochastics.