Supply and demand is a factor that influences markets all around the world. According to the law of demand, demand is inversely proportionate to price. When the price of a product rises, demand falls because buyers do not want to spend too much money on it. When the price drops, however, demand increases because consumers are anxious to purchase. According to the law of supply, supply is directly proportionate to price. Because vendors do not want to sell at such a low price, supply is low when the price is low. However, when the price is high, the supply increases as well, because the sellers want to offer the products for the best possible price.

These are the basic supply and demand laws. Let’s look at how to trade using supply and demand zones in the forex markets.

How to recognize the supply and demand zones

The vast region of support and resistance levels can be used to identify supply and demand zones. However, the concept behind them is different. Because support and resistance levels are linked to previous peaks and bottoms that are clearly visible to market participants, they operate. The term “cheap” or “expensive” is used to describe supply and demand. The supply is produced at the resistance level, while the demand is formed at the support level.

Look at the long candles that appear afterward to locate the supply and demand zones. Then you must determine the cause of the price’s rapid movement, which is usually sideways fluctuation.

How to trade the supply and demand zones

When the price falls into the demand zone, it is usually a sign that the market is about to move upwards. This indicates that you should initiate a buy position. Instead of Fixed Time Trades, use currency pairs (CFDs) on any trading platform. Set a Stop Loss immediately below the demand zone (or above supply zone for sell positions).

When the price approaches the supply zone, it usually falls quickly. That is why you should keep your entry short.

Occasionally, the demand zone transforms into the supply zone, or vice versa. It’s like to flipping roles between support and resistance.

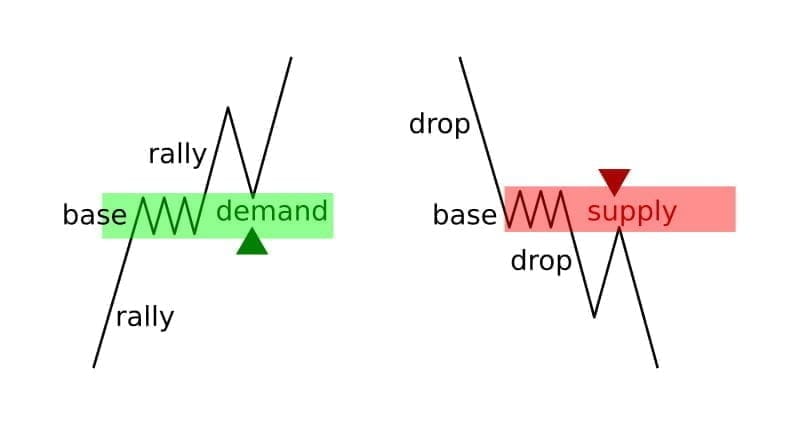

Supply and demand can take many different forms. Let’s look at a handful of the most frequent ones.

Supply and demand Trend continuation patterns

Trend continuation patterns can be formed by demand and supply. It happens when the price rises, then fluctuates, forming the base level, and then rises again. After that, we can say that a demand area has been created. When the price returns to the demand level after the rally, you should enter a long position.

The pattern is formed when the price falls into the base and then breaks through and moves further down during a downtrend. When the price returns to the supply zone after the rally, open a sell trade.

Supply and demand Trend reversal patterns

When the price falls, it moves within the base for a while before changing direction, giving us a demand zone and possibly a demand reversal pattern. When the price reaches the demand level again, you should open a buy position.

When the price moves downward after the uptrend and fluctuating within the base, it forms a supply reversal pattern. As a result, you should start a sell trade here. Enter when the price is returning to a previously established supply zone.

Supply and demand flip zone

The condition when demand turns into supply is referred to as a “flip zone.” The supply and demand zones will eventually run dry. It occurs when the price crosses through the zone and continues to move. Occasionally, this will result in the price forming a new basis for a new supply/demand pattern. Then we can argue that the zone’s function has shifted.

How strong are demand and supply zones?

The types of candles that appear after the breakout from these levels can be used to gauge the strength of demand and supply. When the price swings sharply up or down and the candles are lengthy and of the same color, it indicates a high demand or supply. When the candles are medium length with periodic retracements, the zones are still deemed powerful. After a period of low demand or supply, the price is moving slowly.

The amount of time spent in the zone is another approach to judge whether the level is strong. In this situation, the amount of time spent in supply or demand is inversely proportional to the strength of the area. Such a brief stay in the zone indicates more out of balance demand or supply.

The length of the price movement from demand or supply to supply and back also indicates the level’s strength. When the price moves far away before returning, the level is powerful.

Every time the price returns to it, the level weakens. The zone is the strongest the first time the price reaches demand or supply. It is still pretty powerful the next time, but it weakens with each consecutive return of the price.

When to open a position when trading demand and supply zones

First, you must determine the demand and supply zones. Look for them over a longer period of time.

The following step is to look at how the levels are accepted on the time frame you’d like to trade.

Now, wait for a price action signal before entering the trade.

An hour time frame for the GBPUSD currency pair is shown below as an example.

When you see a strong demand or supply area, you should enter a trading position.

Conclusion

Check out my forex tools that can help you identify these zones easily at my shop. All financial markets are based on supply and demand. There are some universal laws that apply to them, which you may utilize to determine the optimal entry opportunities for your trades. These tactics do not guarantee a profitable trade 100% of the time, but they do reduce risk and increase your chances of success, which is the most you can hope for with any approach.