Forex trading, like pretty much everything else in the financial world, can be rather risky at times, making you wonder if it was even worthwhile to begin trading in the first place, and if Forex trading can be successful at all. Even those traders who have made trading their primary source of income have lost money in the past, and they continue to do so now. However, in that situation, the risks are justified. After all, trading is a process that is compiled from experiments and learned through a long trail of mistakes.

As a result, one must be prepared for potential losses and educate themselves on risk management. However, the fact that the market is still open and its entire cash flow is about $5 trillion per day may be proof that Forex trading may be profitable and effective. However, it must first be thoroughly researched and assessed.

Having said that, it could be a good idea to ask yourself if you are the type of person who can endure adversity and learn how to trade Forex profitably. Because you can either make a profit or lose money when trading Forex. Profiting from Forex trading, on the other hand, is unquestionably possible and attainable. Otherwise, the platform would have just faded and vanished with the passage of time.

How much you can lose from forex trading depends on your risk management game. Remember you can control what to lose by using stop loss, right lot size and others.

Important things to consider when trading forex

Let’s pretend Jonathan is a middle-aged trader who has just been trading for a month. He wants to start generating substantial money from trading and is frantic for answers to his key query, ‘Is Forex trading profitable?’ We’re going to provide Jonathan a few simple principles to follow that will hopefully assist him. Notably, those tactics, bits of advice, and constraints can, if not eliminate, at least reduce the potential losses for Jonathan and you.

So there you have it:

1. Use a smart and consistent trading strategy

For different persons, the trading method may appeal as diverse random aspects. The strategy, though, must be something you can stick to and that will keep you disciplined. That way, you won’t be questioning yourself, “Is trading Forex worth it?” You will simply begin producing money and gain a consistent profit. As a result, your strategy may be based on trading specific currency pairings or trading specific currencies on multiple markets; it is entirely up to you.

The Forex trading strategy should ideally state your target market, the maximum risk you’re willing to accept, the entry and exit points, as well as trading strategies such as the platform and unique tools you’ve chosen.

To cut a long story short, let’s take a look at the components of a good trading strategy. And make a list of the things you should avoid at all costs as a new trader.

2. Invest Wisely

Jonathan is a hazardous character; he knows what he wants but isn’t sure how to get it. Even while it may be beneficial to take risks now and then, such risk must always be justified! The most important criterion for effective trading is to keep the Forex trading risk to a maximum of 2% each trade. That manner, any losses that may occur will not have an impact on your style of living.

Even though it may appear to be a simple task for Jonathan, limiting risks also means controlling the amount of money spent on trading. This may appear absurd, since who would want to invest more money in something as volatile as Forex trading? However, many people believe that the more they invest, the more they will profit from the trade. However, regrettably, this is not always the case. There are numerous publications that chronicle the story of successful brokers who lost all of the money they had accumulated over many years in a single day.

Trading must not account for more than 20% of the trader’s total capital. Jonathan does not expect Forex trading to become the company’s primary source of earnings in the next few years. Jonathan would be advised to open a demo account first and practice trading without risking any of his own money. It is usually preferable to begin modest, as this will help you to progress further over time.

3. No impulsive trading

That is the major thing that our trader Jonathan wants to stay away from. Only relying on the statics and your previous trading history can make Forex trading profitable. It is a big no-no for traders to use emotions and other cognitive elements to rationalize their trading. That is a domain that necessitates a clear head and a cool heart. The stop-loss strategy, which we’ll go over in more detail later, was established with the goal of giving traders complete control over potential losses and preventing emotions from influencing their decisions. Each trade must be planned ahead of time and thoroughly examined.

Emotional discipline is the key to Jonathan’s success in trading, as it is for you, my reader. Regardless of how well things are going, you must never allow your emotions to influence your decision-making ability.

The Best way to trade profitably

Jonathan must first comprehend that there is still a substantial chance that he will lose money before he can start trading profitably. The crucial question is whether Jonathan, like you, would stop on the way to achieving your goal. If the answer is no (which it should be) and you’re still interested in learning how to profit from Forex trading, keep reading because you’ll find key tips for successful Forex trading below.

Of course, purchasing for less and selling for more is, in general, the notion of lucrative Forex trading. Doesn’t it sound lovely? Is it, however, that simple in real life? Let’s see what happens.

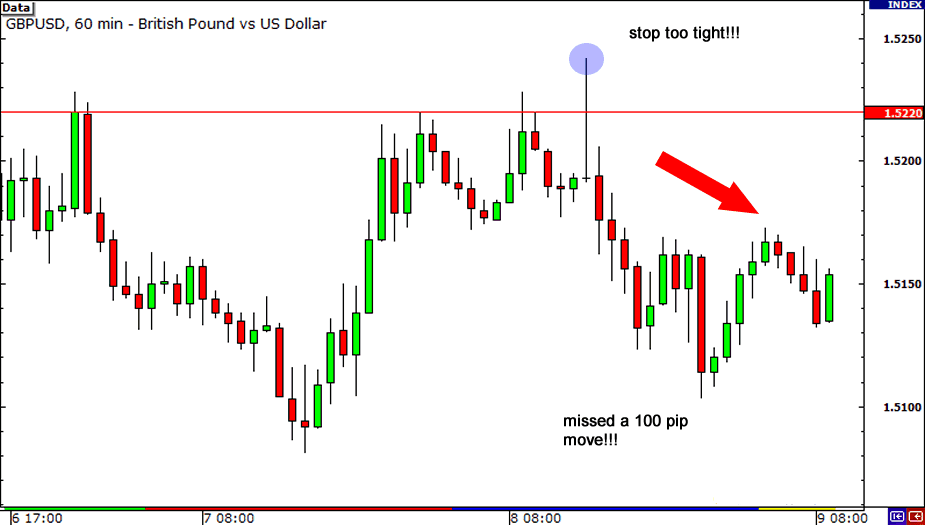

As previously stated, you must always keep to the plan and limit the amount of prospective loss so that it does not adversely affect your standard of living. Having said that, we’d like to return to the stop loss position. This essentially allows you to set your personal limit for the amount of loss you’re willing to accept. Once it’s set, you’re pretty much safe from any sort of force majeure. Notably, some experts refer to this as ‘financial management.’ The name says it all: the setting allows you to manage your personal budget without being harmed by market volatility.

It is natural for people to feel superior when they make a profit and defeated when they lose money. Here’s where the losing limit comes in handy, ensuring that we don’t lose more than we can handle.

Even while the restrictions may alter over time and depending on the markets traded on, it is nevertheless recommended that you do not increase them during your first few months of trading.

1. You should keep your emotions aside, always

It may seem self-evident, yet it can be difficult not to get caught up in the ‘game’ and go all in. You must always remember that your emotions are your worst adversary as a trader! You must be as reasonable as possible in order to maximize your profit from Forex trading. Because Forex trading is a combination of analysis and discipline, it does not have a place for games, despite the fact that it is sometimes mistaken for one.

Keep yourself informed about market movements.

the most effective methods for making money in the forex market

You must always keep yourself up to date with the most recent news in order to earn on Forex. Because they are the ones who have an impact on currency rates. As a result, make sure you’re reading the Forex news calendar on a regular basis and using additional Forex trading tools that will make trading much easier for you. You can easily make precise predictions about how the currency exchange rate will change in the near future once the economic calendars update the dates of upcoming events or emphasize those that have already occurred. As a result, you can begin preparing your portfolio ahead of time in order to trade Forex as profitably as possible.

Using Forex signal providers can also assist you in learning how to profitably trade Forex. Signal providers are, in general, tools that help you determine whether to buy or sell a particular currency at any given time, as well as how to use Forex trading to make the most money. Those could be either free or compensated. Furthermore, the signal providers do not always have to be a platform or a tool; they may be be a piece of news that influences your trading decisions. JKonFX, DDMarkets, 1000pip Builder, Forex Mentor Pro, Daily Forex, and others are among the most prominent and reliable signal providers. However, it is critical to apply the signals in a timely manner, since failing to do so may result in the loss of a good transaction.

But, hey, let’s get right to the point of this article: what is Forex trading profit per day, and can anyone make money trading Forex?

How much money can you make trading Forex?

In general, the magnitude of your daily profit is mostly determined by the size of your deposit as well as the size of your trades. Simply said, your profits can rise in tandem with the amount of money you spend on trading. Losses, on the other hand, are possible. Forex is regarded for being a place with limitless potential for both losses and rewards. You never know how the market will evolve in this so-called game of probabilities. So, whether you take the money out of the transaction or stay in and maybe gain more is entirely up to you.

Everyone who begins trading on the internet wants to know if Forex trading is still profitable and, if so, how to earn from it.

A multitude of things influence your daily/monthly profit. These factors could include your understanding of the Forex market, the sort of market you’re trading on, the amount of time you devote to researching and studying Forex market fluctuations, and, of course, the amount of money you start with. As a result, if you invest $2,000, you will make significantly less money than someone who invests $20,000. Keep in mind, however, that investing more than 2% of your portfolio is not suggested. After all, the goal of Forex trading isn’t necessary to make a significant profit, but rather to avoid losing a lot of money.

fx-profit-maximum

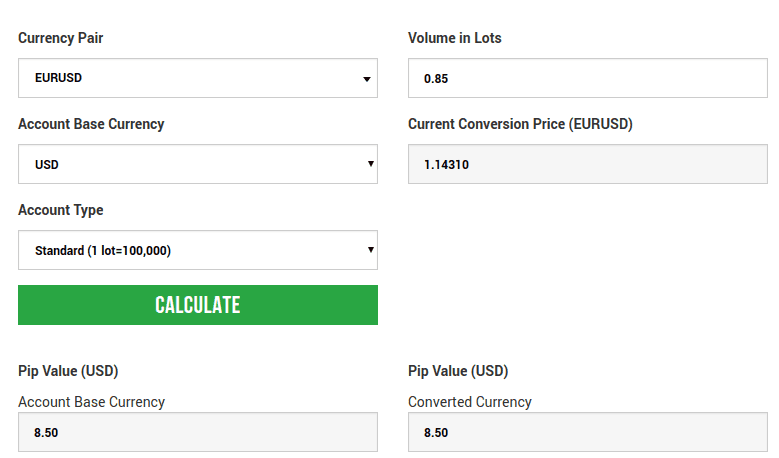

Is it profitable to trade Forex online? Yes, if the strategy is well-thought-out and effectively implemented in practice. Let’s return to our trader Jonathan to make things a little more clear and specific. Let’s imagine Jonathan has $6,000 in his account and he decides to set the loss limit at 1% at initially, resulting in a maximum loss of $60. Jonathan can expect a $10 gain/loss if he trades a standard lot, $1 if he trades a mini lot, and $0.10 if he trades a micro lot, depending on the currency pair. The currency pair chosen is EUR/USD, which is thought to be quite stable.

Now, let’s imagine Jonathan can trade 8.5 mini lots with 7 pips, resulting in a risk of $59.5 per deal. Isn’t that significantly less than Jonathan’s 1% risk ($60)? A win equals $10 in a 10-pip position, and a loss equals $7 in a 7-pip position. Therefore, if Jonathan trades 5 times every day, he will have completed 100 trades if he trades 20 days out of 30 in a month.

Using simple mathematics and assuming a monthly win rate of 50%, we can calculate that if 50 trades are lucrative and 50 are not, the profit may total $4250. Meanwhile, a loss of $2975 is possible. As a result, Jonathan’s net worth will be calculated at $1275.

However, there are also costs associated with broker taxes, which can vary from $0.2 to $0.5 each transaction. As a result, the maximum tax bill will be around $425. After paying the brokers’ commissions, the pure net will be somewhere about $850. The following is how the taxes are calculated: $425 = 100 transactions x 8.5 micro lots x $0.5

Of course, those calculations can’t tell you how much money you’ll make this month. They can, however, show you what the logic behind the profit calculations might be. Pip calculators can also assist you in determining expected risks, returns, and pip values.

Conclusion

Having said that, it is always difficult to anticipate what the Forex trading profit each day will be, as it is dependent on a variety of circumstances. As a result, the experts devised a concept known as’slippage,’ which allows for unpredicted loss. It is simple to compute by subtracting an additional 10% from the net profit.

By the end of the month, you should have a 10% -15% return if you maintain discipline and use proper approach. Nonetheless, you must be prepared for the possibility of losses. Even while the Forex market appears to be a lucrative investment opportunity, it is difficult to forecast how the market will evolve and what the exchange rates will be in the coming weeks.