Government securities are debt products that the Zambian government, through the Bank of Zambia, issues. The government borrows money from the people who purchase the debt instruments by issuing them. Treasury bills and government bonds are examples of these debt products. On the instrument’s maturity date, the Zambian government is required to pay the holder of the Treasury bill or Government bond a certain amount of money.

Therefore, by investing in government securities, you are effectively lending the Zambian government money.

Why does the Zambian Government issue Government Securities?

The Zambian Government issues Government securities to raise funds needed to

pay off maturing debt and inance its operating and development expenditures

that cannot be fully met from tax revenues.

What is the difference between a Treasury bill and a Government bond in Zambia?

Treasury bills are short-term debt instruments that the Zambian Government

issues in order to borrow money for a period of up to one year. Government

bonds are relatively longer-term instruments that the Government issues to

borrow money for a period of more than one year.

The other difference is the manner in which Treasury bills are bought and how

the interest is paid. Treasury bills are always bought at a price less than their face

(par) value. On maturity date, the Government pays the holder of the Treasury

bill an amount of money equal to the face value. Therefore, the interest earned on

the Treasury bill is the difference between the price you pay to buy the security

and the face (par) value you receive on maturity date.

Unlike Treasury bills, Government bonds can be bought at prices that are either less (similar to

treasury bills), equal or more than their face value and the Zambian Government

pays a ixed rate of interest called the coupon every six months and the face (par)

value on maturity date.

Why should a potential investor purchase a Government Security?

Government securities are a safe and secure investment because the full faith

and credit of the Zambian Government guarantees that interest and principal

payments will be paid when they fall due. Government securities are a liquid

investment, which means that they can easily be sold for cash and/or used as

collateral for loans.

Who is eligible to purchase Zambian Government Securities?

There are no restrictions to eligibility. Business irms, institutions, foreign

entities, and individuals are all eligible to purchase Government securities at the

Bank of Zambia. However, there are two key requirements; (i) every investor

must have a local commercial bank account denominated in Kwacha and (ii)

register on the Central Securities Depository at Bank of Zambia.

How are Zambian Government Securities issued?

The Bank of Zambia issues Government securities on behalf of the Zambian

Government. Government securities are sold at auctions on a competitive basis

and on a non-competitive basis.

Competitive basis (auction): Investors compete to lend money to the

Government by specifying an interest rate and the face value of securities they

wish to purchase. The Bank of Zambia then ranks all bidders and allots securities

irst to the investor with the lowest interest rate followed by one with the next

lowest interest rate in that order until the amount of securities on offer is fully

allotted.

Non-competitive basis: Investors do not specify an interest rate. Instead,

investors are willing to be allotted securities at an interest rate determined in the

auction. The return on the investment is determined from the cut-off price/rate

prevailing at the auction. Therefore, an investor does not have to specify the

return they would like to receive. Here, the investor is a price taker.

Is there any minimum or maximum amount of securities I can purchase in Zambia?

The minimum amount that one can invest is K1,000 face value for both Treasury

bills and Government bonds. However, investors purchasing amounts ranging

from K1,000 to K499,000 will fall in the non-competitive window while investor

purchasing K500,000 and above will fall in the competitive window.

Investments in the non-competitive window are made in multiples of K1,000

and those in the competitive window are made in multiples of K5,000.

How are Zambian Government Securities priced?

Government securities are currently issued using a single price auction method.

This means that if you participate as a competitive bidder in the auction, you may

not pay the price you have indicated in your application, but the cut-off price. All

successful bidders are awarded the cut-off price. The price is quoted per K100

face value. If you choose to submit a non-competitive bid instead, you will pay the

cut-off price determined in the auction.

How can I purchase Zambian Government Securities?

You can purchase Government securities by either submitting a bid yourself

directly to the Bank of Zambia or through any of the local commercial banks that

will submit the bid to the Bank of Zambia on your behalf. You will be required to

indicate your bid on an appropriate application form that can be obtained from

the Bank of Zambia ofices or can be downloaded from the Bank of Zambia

website (www.boz.zm). Before purchasing any security, you need to register

with the Bank of Zambia by providing personal details on a Central Securities

Depository (CSD) Application Form. The CSD is the Bank of Zambia Government

Securities Registration and Settlement System. Once registered, you simply need

to submit a bid for the security you wish to purchase.

How can I submit my application?

Applications for Government Securities can be submitted through any one of the

following ways:

Ÿ Through the Bank of Zambia as long as investors obtain a Letter of Guarantee,

which is a statement from your respective commercial bank, that it will make

settlement on your behalf once your bid is successful. Individual investors

wishing to bid through Bank of Zambia should submit their bids by 10:00

hourson the day of the auction, to the Financial Markets Department;

Ÿ Through their respective commercial banks; or

Ÿ Through the Virtual Private Network (VPN) connectivity to the CSD. VPN is a

communications mechanism managed by BoZ which allows secure

communication between users of the CSD. The VPN access can be extended at

a cost, to any investor who wishes to submit bids directly.

Can I cash in my XTreasury bills before they mature in Zambia?

You can sell any amount of Treasury bills to any willing buyer in the Government

securities secondary market should you need cash before the maturity date. The

secondary market is the place where securities that have already been issued are

traded (see appendix I for the general procedure on buying and selling securities

in the secondary market).

Can I Cash in my Zambian Government Bonds before they mature?

You can sell any amount of Government bonds to any willing buyer in the

Government securities secondary market should you need cash before maturity

date (see appendix I for the general procedure on buying and selling securities in

the secondary market).

Beneits of investing in Government Securities

Government Securities offer a combination of the following beneits:

Ÿ Government securities have been dematerialised. This means that all records

are stored and processed electronically. This feature makes Government

securities safe and allows transactions in varying denominations.

Ÿ Government securities can be pledged as collateral to obtain a loan from a

commercial bank or any other inancial institution.

Ÿ The timely payment of interest and principal at maturity on Government

securities is guaranteed by the full faith and credit of the Zambian

Government. This makes Government securities a very safe investment.

Ÿ Government securities are liquid and transferable.

Are there any charges to my interest income on Zambian Government Bonds?

For Government bonds, only your coupon interest income is subject to the

current 15% withholding tax and a 1% handling fee both of which are deducted

on the payment date. However, the discount income is not subject to any charges.

Are there any charges to my interest income onTreasury Bills in Zambia?

For Treasury Bills, your interest income is subject to withholding tax, which is

currently 15%, and a 1% handling fee, both of which are deducted when

Treasury bills mature.

Once purchased, where are Zambian Government Securities kept?

Government securities are safely held in electronic record form on the CSD at the

Bank of Zambia. The securities can be held in one of two ways, either directly

under an account created in your name as an individual or under the custody of

your bank in a designated customers account.

How long can I lend my money to Zambian Government through Government Securities?

The Zambian Government borrows money through Treasury bills currently for

four maturity periods, namely 91 days, 182 days, 273 days and 364 days. The

Government also borrows money through Government bonds currently for six

maturity categories, namely 2 years, 3 years, 5 years, 7 years, 10 years and 15

years.

How frequent are auctions of Zambian Government Securities held and how can I

find out when an auction is held? What about the results?

Treasury bill auctions are currently conducted fortnightly while Government

bond auctions are conducted once every month (investors will be advised of any

changes on the auction frequencies). Government securities auctions are

advertised in the newspapers in the week of the auction. Further, if you have

opened a CSD account and given consent, you will also receive mobile alerts to

notify you of the dates for upcoming auctions.

The advertisements can also be accessed online on the Bank of Zambia website

(www.boz.zm). The results of your bid will be communicated to you on the

business day following the auction. Summary results of the entire Government

securities auction are published on the Bank of Zambia website on the day of the

auction and in the newspapers every Monday following the auction.

How do I make or receive payments for my Government securities

transactions and receive interest payments?

All payments are made through commercial banks. Interest income on Treasury

bills (discount) is only paid at maturity together with the money you invested

(principal). Interest income for Government bonds is paid every six months and

the money you invested (principal) is only paid at maturity. The six-month

interest payments are called coupon payments and calculated as follows:

Coupon Payment = Face Value of Bond X (Coupon Rate/100) X

(No. of Days in Coupon Period/365 Days)

How do I calculate how much money I need to invest? What about my

interest income?

Given that the price information on Government securities is usually expressed

in terms of interest rates, you need to convert your required interest rate to a

number expressed in kwacha terms.

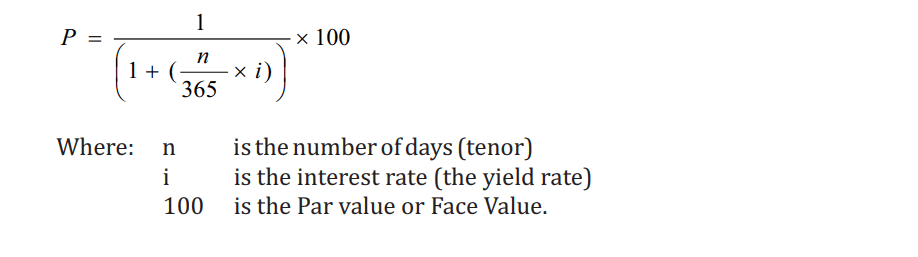

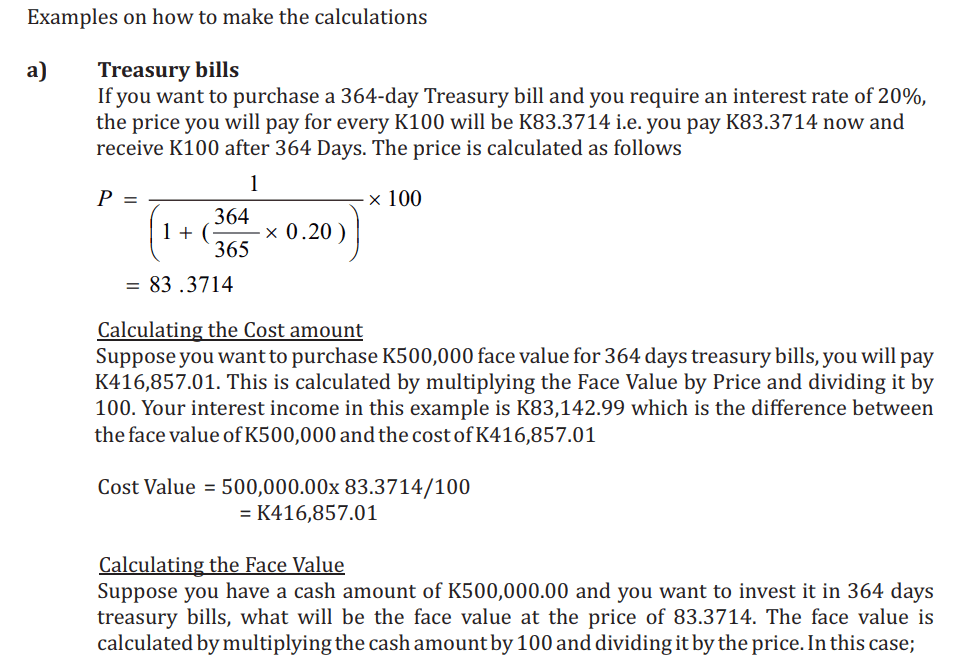

For Treasury bills, the following formula is used to obtain the kwacha-price:

Conclusion

Procedure on buying and selling securities on the secondary market

I. The client places an order to buy or sell a security with a market maker or through a broker.

In Zambia, most Commercial banks are market makers and also act as brokers. Other

brokers can be found on the Lusaka Securities Exchange (LuSE).

ii. The market maker or broker quotes a client a price.

iii. If the price is acceptable, and the client is selling the security, the client gives his bank the

instruction to transfer the security to the market maker who in turn delivers the cash to the

client through the client’s settlement bank.

iv. In the case where the client is buying the security, if the price is accepted, the client issues

an instruction to their settlement bank to transfer the cash to the market maker who in

turn after receiving the cash transfers the security to the client via the client’s settlement

bank.

To protect the market maker from potential interest rate and settlement risk arising from the nonsettlement of the security and/or cash by the client, the client may be required to either open a

cash account with the market maker’s settlement bank or the client may be required to instruct

their settlement bank to guarantee the transaction before it is conirmed. Please note that banks

have processes and requirements that may differ, and speciic details may be obtained from the

banks.

Face Value = (Cost Value x 100)/price

=500,000.00×100/83.3714

=599,726.03

Face value amounts of K500,000.00 and above are placed in multiples of K5,000.00.

Therefore, you can either invest a face value of K595,000.00 of which you will pay

K496,059.84 or K600,000.00 of which you will pay K500,228.41.

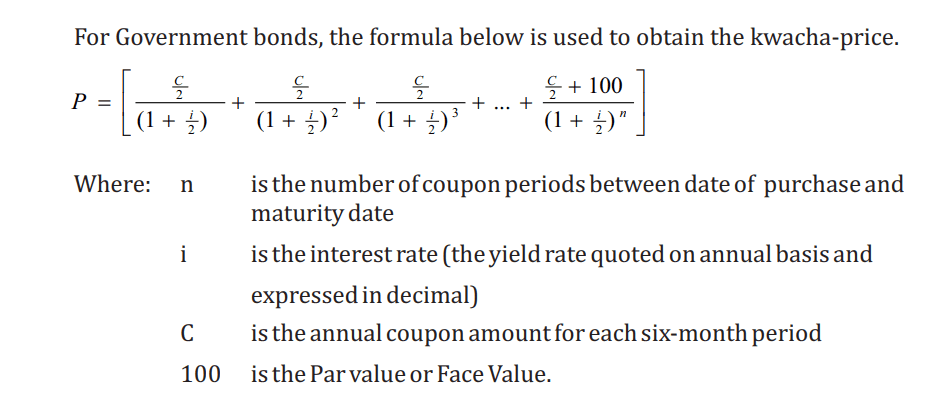

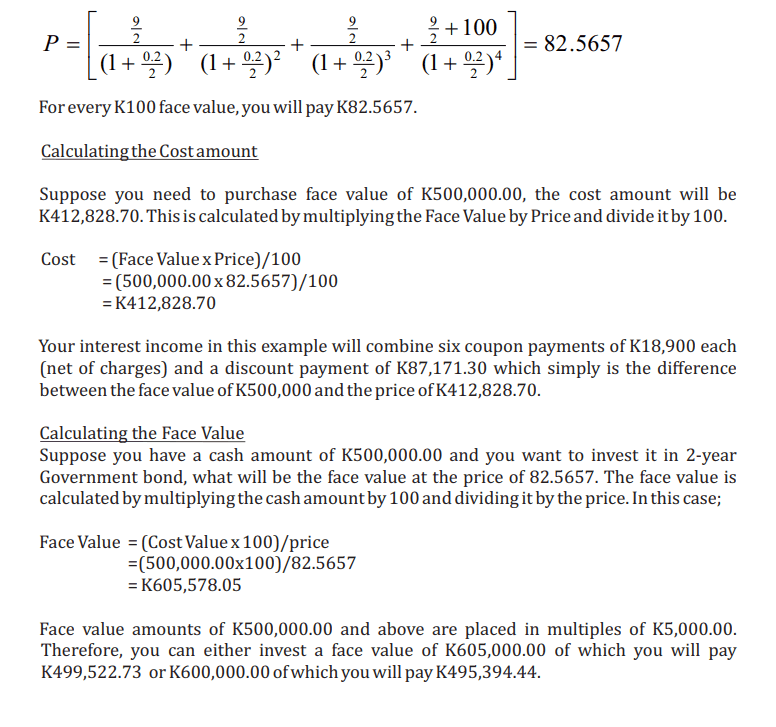

b) Government bonds

Suppose you want to purchase a 2-year Government bond with a coupon rate of 9% you

require an interest rate of 20%, the price is calculated as follows:

Thank you Keith for this info, it’s inspiring to know that Zambian youths like you have interest in such and are willing to share.

Very insightful – I will invest.

I would love to invest if guided and helped with the procedures