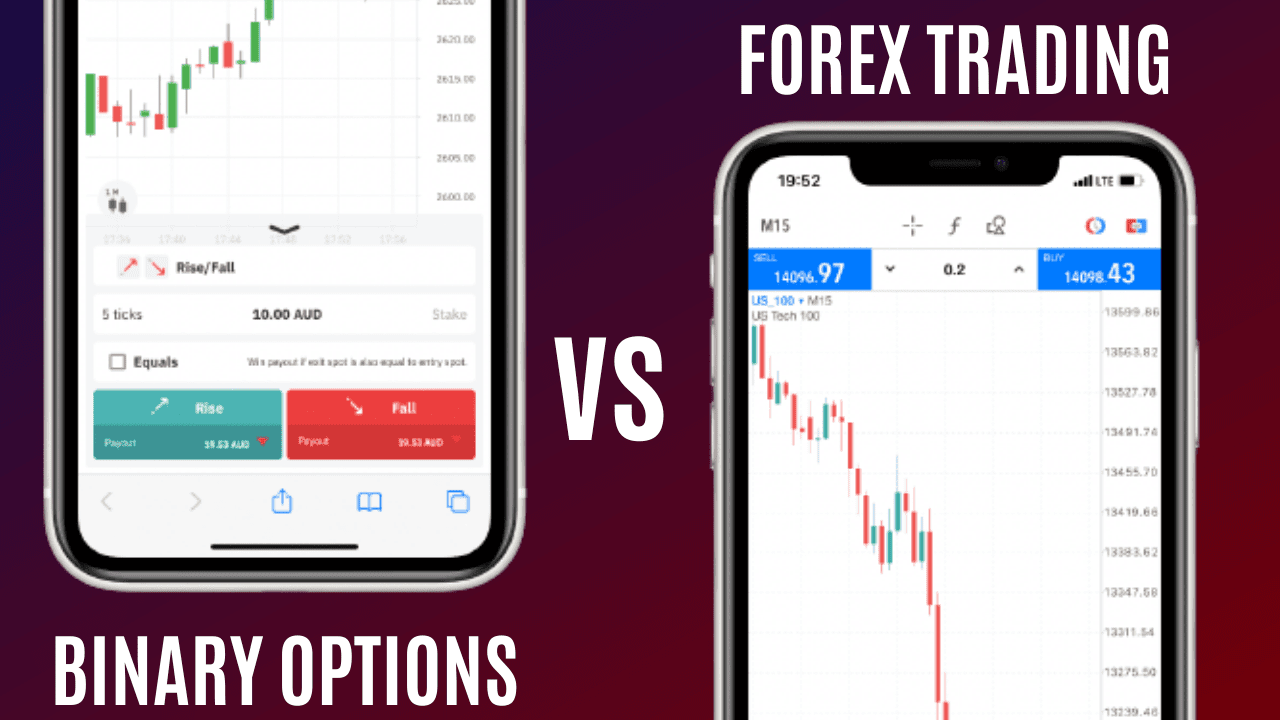

The two most popular forms of trading are forex and binary options. Each one has its own set of advantages and disadvantages. The former has a lower risk and a higher payout, while the latter has a low risk but higher payout. Traders should make a careful comparison to determine which is best for their needs. There are several important differences between these two types of trading, but in general, binary options are the better choice for the average investor.

Watch this practical detailed video:

What is a binary option?

A binary option is a fixed-reward option in which you must choose between two possible outcomes and predict the outcome. You will be paid the agreed-upon amount if your forecast is right. If you don’t, you’ll only lose your first investment. The term ‘binary’ refers to the fact that there are only two possible outcomes: win or loss.

What is forex trading?

Forex trading always involves selling one currency in order to buy another, which is why it is quoted in pairs.

Foreign exchange, or forex, can be defined as a network of buyers and sellers who exchange currencies at a pre-determined price. It is the process by which individuals, businesses, and central banks convert one currency into another; if you have ever traveled abroad, you have almost certainly done so.

While some foreign exchange is done for practical reasons, the great majority of currency conversions are done in order to make a profit. Because of the large volume of cash that is converted every day, some currencies’ price changes can be quite erratic. This volatility is what makes forex so appealing to traders: it increases the possibility of large earnings while simultaneously increasing the danger.

Forex trading has a high degree of risk. The volatility of the market can affect profit margins, especially in the short term. Since the prices are fixed in forex, traders have to worry about their trade’s direction. In contrast, binary options do not have this concern. Besides, a binary option can be closed anytime. Therefore, forex is more suitable for those who want to learn how to master the art of currency trading.

When it comes to managing risks, forex is better for experienced investors with a lot of experience in trading. A trader can use market and limit orders, and they can master the nuances of active trades. The currency market is open 24/7, so it is a good choice for those who want to invest in the currency market but don’t want to risk a large amount of money. Both forms of trading come with certain benefits and disadvantages.

Both types of trading have different payouts. With the former, you can execute limit and market orders. The latter allows you to trade currency pairs twenty-four hours a day, five days a week. On the other hand, the latter requires you to be available to the market, which makes it a better option for those who prefer to work from home. These types of trading are often easier to learn and are better for beginners.

The two types of trading have many advantages. In forex, the latter is more popular with retail traders as it doesn’t require large investments. While binary options do not require large investments, forex trading requires a much larger investment. The lower leverage offered in forex means that the risk of losing money is greater, which is why the currency market can be more unstable. Traders in the latter are more likely to lose money.

The biggest difference between forex and binary options is the size of the trades. In forex, there are fewer assets to trade in, but the returns are generally higher. In forex, the smaller number of assets can be manipulated. As a result, traders should make sure they know what they’re investing in before they invest. However, the binary options industry is not without its risks. Although it is more competitive than the forex market, it does offer a lower risk and higher potential for profit.

Both are profitable, but the former is more risky. It requires extensive knowledge of currency and can be complicated to get the hang of. While binary options are less risky than forex, they do require a large amount of capital. While you can make a small investment in forex and binary options, the former has the potential for substantial profits. You can only invest a certain amount of money in a single market.

Unlike forex, binary options have a wider range of risks. In binary, the risks are lower. While both types are risky, they are similar and have many advantages. It is best to know the differences between them before making a decision. You can use both types of trading to meet your goals. If you’re interested in forex, you should decide what type of trading is best for you. You’ll need to understand both methods before you make a decision.

While forex trading is risky, binary options have lower risks. When you win, you will receive your money back plus a profit. In binary options, you’ll be paid back the total of your investment. If you lose, you’ll lose the difference between your losses and profits. In the forex market, you can use the same strategy for both. While Forex offers more opportunities for investors, it’s a better choice for beginners.