The ability to identify support and resistance is the foundation of the rectangular pricing pattern. It can give you consistent results in a short period of time. This guide will teach you how to spot the pattern and how to use it effectively when trading.

How do I spot a rectangular price pattern?

Let’s talk about the range market for a second. Prices rise to a certain level before dropping to a different level. A higher price produces a level of resistance, whereas a lower price gives support. They are so strong that once the price reaches them, it simply bounces back without breaking out of the resistance or support.

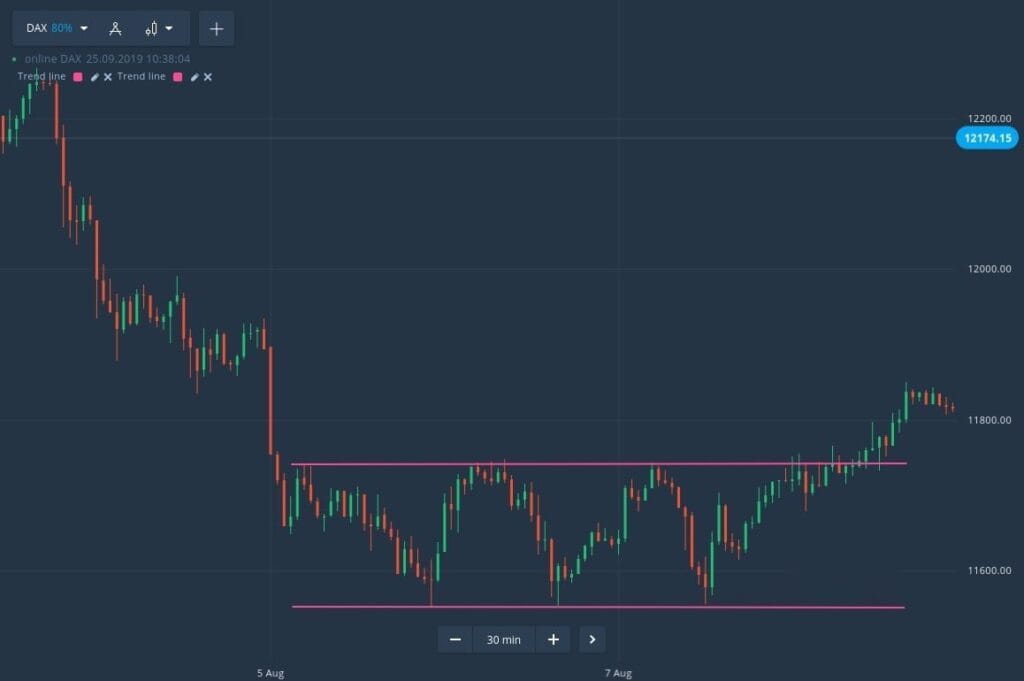

Lines that are parallel to one other are used to produce support and resistance. At least two bottoms will be joined to form the support line. At least two tops will be connected by the resistance line. Take a look at the DAX chart below for the last 30 minutes.

When a trend is coming to a conclusion, the rectangular pattern is visible. It denotes a shift in the trend’s direction.

As a result, the best time to look for price consolidation is at the top or bottom of an upward or downward trend. And what it means is that the directed movement is over and the trend is about to turn around. Prices do not exceed or fall below a specified level at this time.

When the rectangle pricing pattern appears, what should you do?

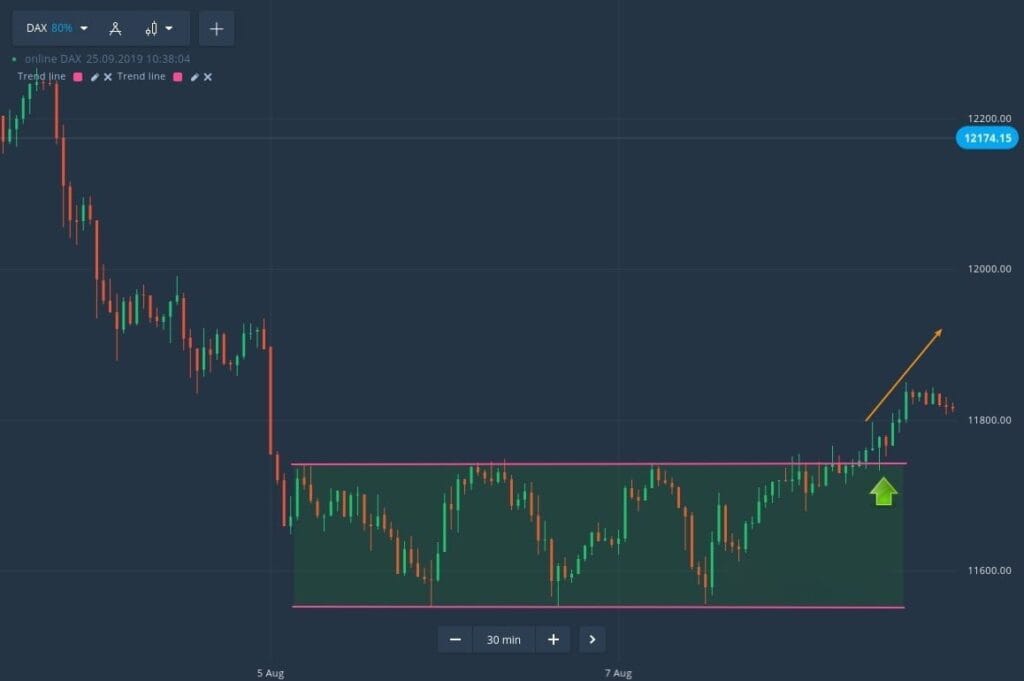

Once the pricing boxes pattern has developed, it is usually straightforward to spot. But don’t be concerned. You may still be able to profit from it before the new trend starts.

Drawing the support/resistance lines should be your initial step. Then keep an eye out for when the price crosses the lines. You should open a buy position when the support line is reached. Open a sell position if the resistance line is touched.

When trading short-term deals, we recommend using the large time frame chart. If you’re trading on a 30-minute chart, for example, open 5-minute trades. As a result, you may be confident that the price will remain within the rectangle and will not rebound before the trade expires.

What to do when the price breaks out of the support or resistance level

You must be ready for the price to break through the support or resistance level. Sooner or later, it will happen. After the breakthrough, keep an eye on the direction the price is heading and trade accordingly.

As the uptrend develops, you should enter a buy position if the price breaks the resistance level, as seen in our example chart below.

Conclusion

The price boxes pattern lasts for a while, and during that time the price fluctuates within a set range. Finally, when the price momentum is really strong, the barrier is broken. There are certain signs that this is about to happen. For instance, the candles are longer and of the same color. As a result, you have every reason to believe the market will continue to move in the breakout direction.

Taking into account all of the foregoing, you might enter the market in response to a changing trend.