Forex trading: legitimate or fraudulent? This is the query on everyone’s mind. The biggest trading market in the world is the Forex market. Daily foreign exchange trades total more than $6 trillion. Currency pairings are always traded on the forex market.

A completely legal decentralised marketplace where national currencies are exchanged at a rate set by the market is the foreign exchange market, commonly known as the forex market. The spot FX market, which varies from the futures market in that currencies are physically switched in real-time after a transaction is completed, is where the majority of Forex trading occurs. Forex trading includes making predictions about changes in exchange rates.

In the futures market, there are differences between the day the currency is exchanged and the day the trading price is set. Online brokers make trading in the forex market more accessible than ever, notwithstanding the presence of certain scammers.

The number of forex frauds has increased along with the popularity of forex trading. Leverage is a crucial factor in the Forex market. The number of online results for forex broker frauds is astounding. This essentially amounts to a loan from the broker to the trader, enabling margin trading.

It’s crucial to know how to recognise a forex scam before you begin trading. Trading foreign currencies is a legitimate technique to increase your revenue. Unfortunately, even though the forex market is increasingly becoming more regulated, there are still many shady brokers in business.

The forex market.

Forex trading is the practise of exchanging one currency for another. Without intending to hold the currency physically, the traders can protect themselves against potential fluctuations in exchange rates. Like stock traders, forex traders sell currencies whose value may decline and hunt for currencies whose value may increase in relation to other currencies.

Like any other market, the supply and demand of traders determine the price of a currency. Here, the use of foreign currency is important. The Forex market is heavily used by professional traders, financial services dealers, and investment managers.

Even if the average trader generally stays away from the currency market, it still has a lot of potential effects on us. Since there isn’t a single unit of account, there needs to be a way to translate the value of one currency into another. In this market, additional forces may also be at play.

Currency exchange is necessary for international business, international travel, and foreign trade. As a result, the spot market’s real-time activity may have an impact on the costs we incur for international travel.

Is forex trading a scam or legitimate?

The Forex market is an authorised trading venue where you can transact in any currency in the world. There is a steep learning curve involved in turning a meaningful profit in this market. Scammers, however, take advantage of the circumstances and willingness of new traders to enter the market because there is no regulated exchange and large leverage positions can be made.

It is not a scam to trade currencies legitimately utilising trustworthy and well-regulated online brokers and their forex trading platforms. Forex traders deal in pairs of currencies. Therefore, every foreign exchange transaction involves simultaneously buying one currency and selling another. It is not a con in and of itself as a result.

There are less chances for a trader with less cash to get larger returns because many currency movements are governed by large, well-funded corporate entities and banks that are more knowledgeable about the market as a whole. Without the Forex market, it would be challenging for you to exchange the currencies needed to buy imports, sell exports, go on holiday, or carry out international business.

With such a high level of activity and no centralised supervisory authority, a currency fraud may legitimately be a risk. If you choose to trade, you should be aware of a handful of the more well-known ones. Due to leverage and margin, trading in forex carried higher risks than investing in other types of assets. Although currency prices are constantly fluctuating, traders must invest significant capital to make a profit.

For forex trading, choosing reputable and feasible brokers is crucial. We must go through a number of steps to distinguish the strong from the weak and the reputable from those with shady transactions before putting a sizeable amount of money with a broker.

Risks of Forex Scams

Not only is forex trading legitimate, it also has the greatest daily average turnover of any financial market. By hiding crucial information about market reality from their naive rookie victims, scammers take advantage of the complexities of the Forex market in hopes that software robots will make them successful.

Unfortunately, there are certain dishonest online brokers who intentionally mislead you in order to steal your margin deposit or forex trading profits. Although retail forex trading only makes up a small portion of that amount, it could put the unwary at risk of fraud. The issue is that it can be challenging to identify reliable Forex brokers.

Knowing how to trade effectively in the Forex market is one of the most crucial things a person can do to prevent getting duped. Here is a list of common forex scams to stay away from.

Robotic fraud

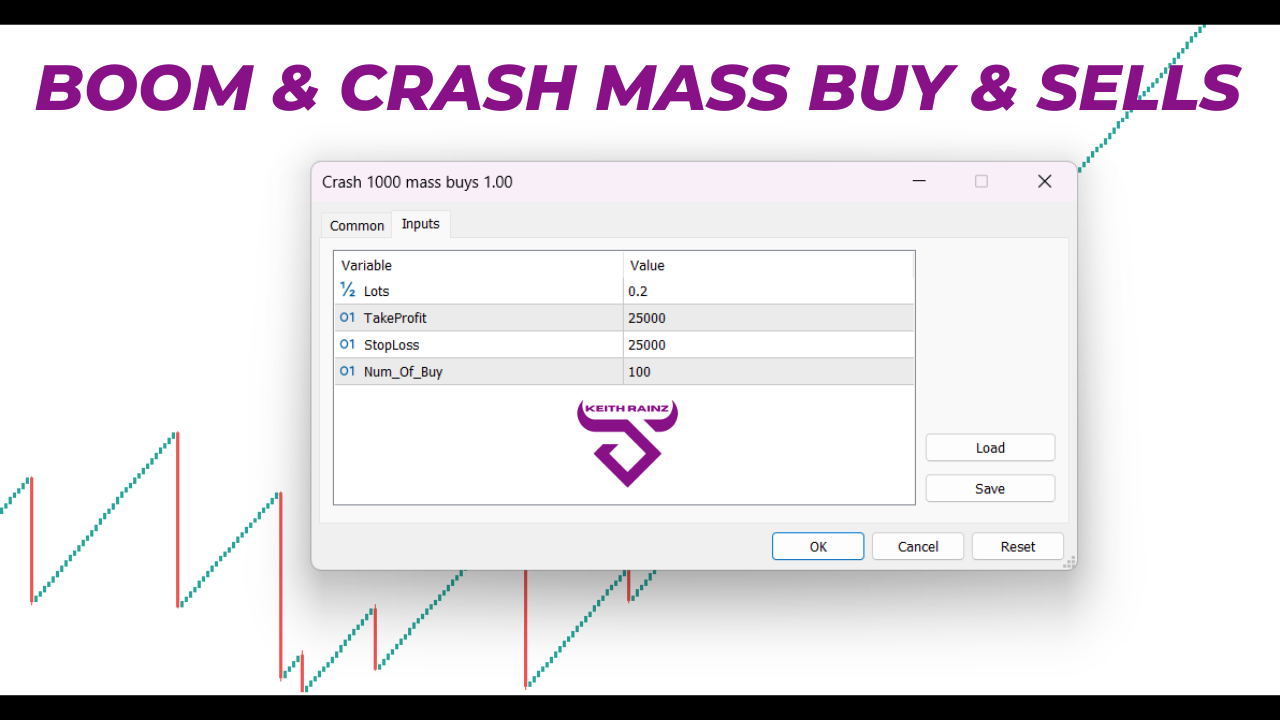

Con artists using forex robots lure newbies with claims of enormous rewards with little effort or expertise. One common practise among forex traders is the use of automated trading algorithms, also referred to as expert advisers. They wouldn’t sell their product if it performed as promised; they would only utilise it.

All software should be independently examined, but because reviews can be purchased, it’s necessary to exercise caution when relying on them. Using alluring, high-pressure websites and phoney testimonials, trading robot vendors attempt to advertise the usually irrational notion of generating enormous returns trading on autopilot without a great deal of human engagement.

To locate trading opportunities and open and close positions on your behalf, these forex trading robots analyse exchange rate data for one or more currency pairs. Since no robot can adapt to and succeed in every type of environment or market, such promises are false. Professionals frequently use software to evaluate previous results and identify trends.

They could present clients with inaccurate or deceptive information to induce them to buy their products. So even while having a robot trade for you could seem appealing, you should stay away from it. Computers manage the trade, choosing whether to buy or sell depending on preset criteria.

After all, everyone wants to be able to make money without working. Scammers would propose trading robots or systems for Forex that would do all the job for you. Unfortunately, despite what we might want to think, computers are not error-free. Furthermore, no one outside the organisation tests or verifies these systems to assure their validity.

It’s not a good idea to base your financial and investment decisions on any system. You will profit while the robot completes all of the work, which is rather lucrative. Furthermore, nobody can predict how the stock market will be affected by major world events or other economic indicators.

Broker fraud

Because they seek to maximise their trading profits, forex traders have a natural urge to partner with the top brokers. Make sure you do your research by looking into any new broker in-depth and examining their reputation in the market and with clients. Some are even unregulated, which means they are exempt from accountability.

The bottom of the broker’s website is a great spot to start reading. However, those seeking for a new broker should be cautious of dishonest forex brokers who might con you. An online service known as a forex broker gives you access to a trading platform so you can easily keep track of your deals. A broker must be used when trading forex.

There is very nothing you can do in terms of taking legal action if you fall into the hands of fraudsters. Instead, brokers will find a method to pocket your cash or overcharge you.

If a broker lacks the regulatory information or loss risk disclosures that reputable authorities require, you must avoid them. Unfortunately, not all brokers are reliable and honest.

Generally speaking, it’s a good idea to research any broker you’re thinking about.

Scam Using Signals

The signal seller scam comprises a person or business selling data-based information on trades based on expert projections that will profit the novice trader. For instance, some forex traders use pre-paid trading signals to help them predict changes in exchange rates.

In order to win the trader’s trust, they typically have a barrage of endorsements from purportedly reliable sources, but they do nothing to foresee profitable trades in reality.

For this service, they typically demand a daily, weekly, or monthly fee, but they don’t give the trader any information that will assist him or her make money. You can get this information from signal providers or businesses that sell data, though.

A historical performance chart of their signals is a good idea to have before joining up for such services in order to validate their promises. This entails that you can select one of them depending on their prior performance and stay away from the more blatant signal scammers.

The bulk of signal providers have a mixed track record, offering both helpful and detrimental guidance. Typically, subscribers must pay a weekly or monthly fee to signal suppliers.

False plans

For a small initial investment, they guarantee substantial gains. Furthermore, since there is no centralised exchange where currency pairs trade to provide official market exchange rates or fixed trading spreads, this industrial activity continues unabatedly.

The truth is that there is no possibility for investment, and their first return is being funded by funds contributed by other programme participants. Fortunately, the profit margins that dealing desks can earn from such unethical behaviour are decreasing as a result of internet trading platforms and growing client awareness of this common practise.

Beginner traders typically experience a return on their investment, and this achievement inspires them to enlist the help of their friends. The scam artists liquidate the business and take the money when the number of investors declines.

What makes communication crucial?

Serious problems could develop when there is improper communication between a trader and a broker. It’s likely that you are being misled, for instance, if you feel compelled to purchase a good or service with little time or knowledge. Unwelcome and persistent marketing is typically a sign of fraud.

Be more cautious if they start requesting sensitive information that could be used for identity fraud, for example. A classic red flag that a broker is not looking out for the client’s best interests is if a trader receives no responses from them or receives vague answers to their questions.

How should I pick a forex broker?

- Don’t forget to read broker reviews and make wise choices. Forex trading is simpler than stock trading because there are fewer currency pairings that can be traded. Look at the current user experience as part of your authorised search. A brokerage company can also give you access to news, tools, and market data that can improve your trading.

- If you want to find out whether negative comments are the result of a disgruntled trader or something more serious, all it takes is a quick online search. Furthermore, forex traders can profit from using an online trading platform, which the majority of brokers offer for free, as there is no centralised market for currency trading like there is for stocks.

- Examine the process of withdrawing money and any additional fees thoroughly. Currently, there are a huge number of online forex brokers available.

- The TradeATF Summary

- I hope I was able to address your question about the legality of FX trading. Forex trading is legal, but you must comprehend certain terminology clearly and stay away from market scams. When trying to find ways to use FX trading to gain extra money, you can run into a few con artists. A trader should thoroughly investigate a broker before opening an account, and if the research is favourable, a small deposit and then a withdrawal should be made. To accomplish this, look into the area in which the company is registered. This is because many Forex scammers operate from areas where it is challenging to bring them to justice under local law.

As a result, it’s crucial to do extensive research and due diligence before entering the industry. The validity of the company making the claims or selling the course is another thing to consider.